Fundamental research:

With a strong and dynamic research team, we deep dive into the universe of stocks and try to find out stocks with strong fundamentals.

...we aspire for 1000% returns in 7 years

SEBI REGISTERED

SEBI REGISTEREDWe aim for alpha generation through long-term investments driven by fundamental analysis, using technical indicators to refine our entry and exit strategies

In the past, our stock recommendations have been guided by a well-defined investment thesis. We focus on sunrise sectors, selecting stocks poised for incremental growth and margin expansion, while carefully timing our entry based on quantitative and technical analysis.

With a strong and dynamic research team, we deep dive into the universe of stocks and try to find out stocks with strong fundamentals.

With the markets becoming dynamic day by day, the need of fundamental research in conjunction with technical research is required to get in early and ride the complete wave of a stock. It helps us to capture the extra few percentage returns during the entry and exits, hence significantly impacting returns on the overall portfolio returns over time.

We maintain a strong team of dynamic individuals having worked in large corporates and Differentiated approach to risk management.

High concentration in high conviction stocks and small-cap centric approach.

Core Portfolio: 70% of our portfolio is dedicated in acquiring multibagger stocks. We select these stocks based on their market leadership, multi-year growth potential, and emerging sector trends.

Satellite Portfolio : 30% of the allocation is focused on achieving higher returns in a short timeframe by investing in tactical picks, with the goal of capitalizing on immediate market opportunities.

I have been thoroughly impressed with WAYA PMS’s consistent and research-driven approach. The team remains grounded and rational, even during volatile market phases. Their professionalism and transparency give me complete confidence to continue investing with them.

WAYA PMS has an in-depth understanding of the Indian stock market and a proven ability to build high-performance portfolios. Their goal of wealth creation resonates with me, and they’ve certainly delivered on that promise.

I've been investing with WAYA PMS for almost 6 months now, and the results have exceeded my expectations. Their disciplined and prudent investment strategy, backed by solid fundamentals, gives me the trust to allocate more capital with them.

Get on a call with our investment experts to evaluate your portfolio & resolve your queries.

Our digital onboarding removes all paperwork ensuring a smooth process for you.

Once you add ₹50 Lakh, Wright PMS will actively start investing on your behalf.

Fixed

2.5 % of AUM

10% Hurdle &

20% Sharing

15%

Sharing

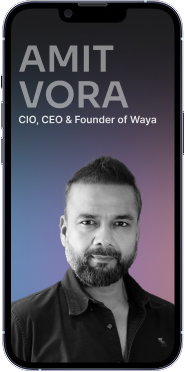

Waya aims to simplify the trading and investment journey for new generations of investors in Indian equity market using technology.